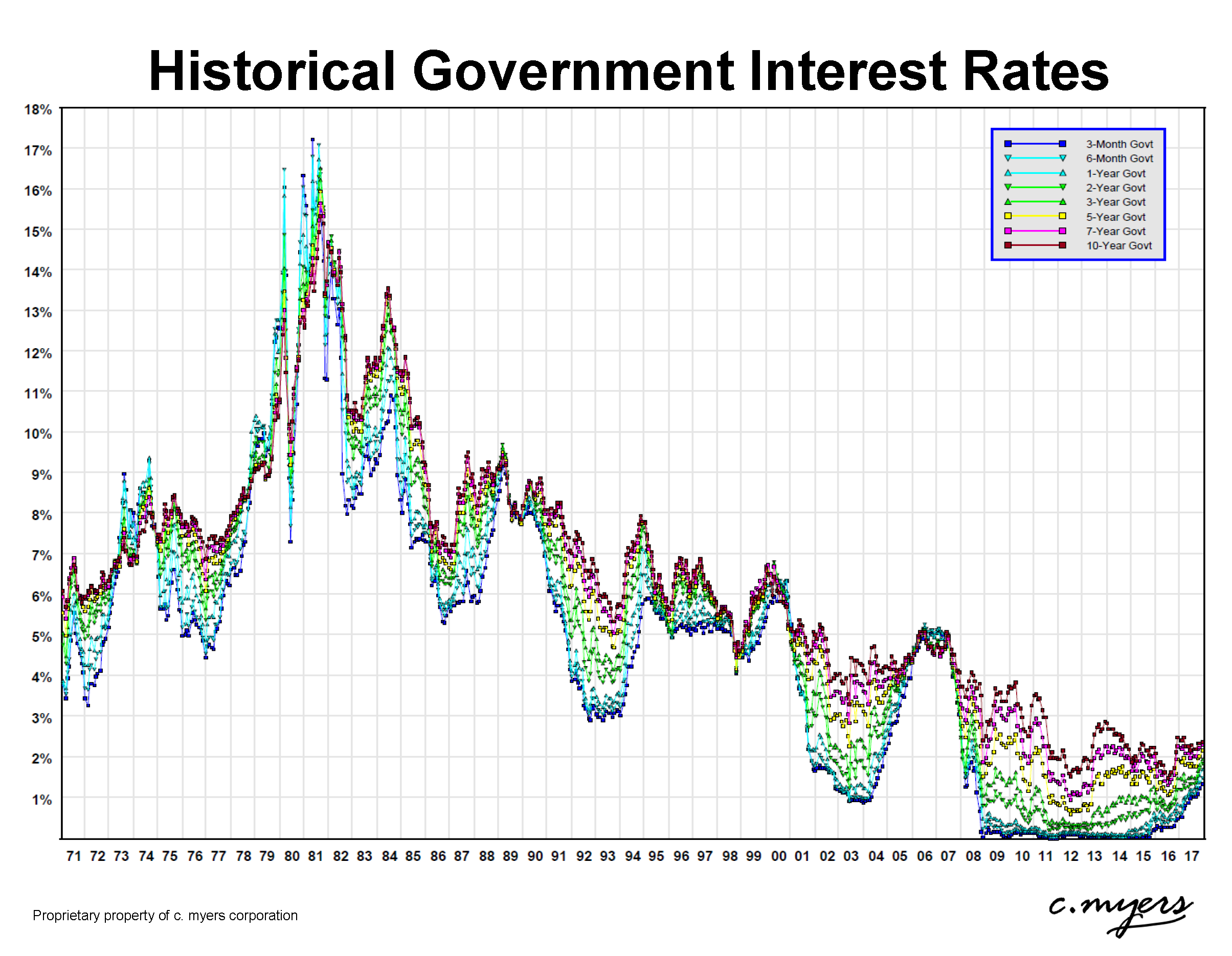

Webjul 29, 2020 · the business interest expense deduction limitation does not apply to certain small businesses whose gross receipts are $26 million or less, electing real property. Webfor taxable years beginning after december 31, 2017, the limitation applies to all taxpayers who have business interest expense, other than certain small businesses that meet the. Websep 1, 2019 · for tax years beginning after 2017, the deduction for business interest expense cannot exceed the sum of the taxpayer's: Floor plan financing interest expense.

Recent Post

- Halifax County Jail Mugshots

- Dr Charlie Ward Bit Chute

- Imdb George Segal

- Kardashian Bikini Photos

- Imdb No Country For Old Men

- Bestbuy Jobs

- Chocolate Graham Crackers Discontinued

- Nyp Org Careers

- Trouble With Cox Internet

- A Hypothesis Is Quizlet

- Psilocybe Cubensis B

- Choose Your Own Schedule Jobs

- Makers Marks Jewelry

- Nypd Guns Off Duty

- John Deere 4200 Problems

Trending Keywords

Recent Search

- Who Is Alina Habba Husband

- Youtube Dr Phil

- Chris Watts House Address

- Jobs Hiring Near Me No Degree Part Time

- Cox Communications Business Support

- Tineco Ifloor 3 Self Cleaning Button

- Milford Ma Patch

- Full Time Job Near Me

- Dee Dee Crime Scene Photoa

- Easy Work From Home Jobs No Experience Needed

- Andrew Weissman Twitter

- 507 Pace Bus Schedule

- Us Food Driver Jobs

- Federal Express Ship Center

- Marie Harf Net Worth

![How To Write A Letter Of Interest In 2021 [Examples + Template] | Steve How To Write A Letter Of Interest In 2021 [Examples + Template] | Steve](https://blog.hubspot.com/hs-fs/hubfs/Sample Letter of Interest Example.png?width=2318&name=Sample Letter of Interest Example.png)