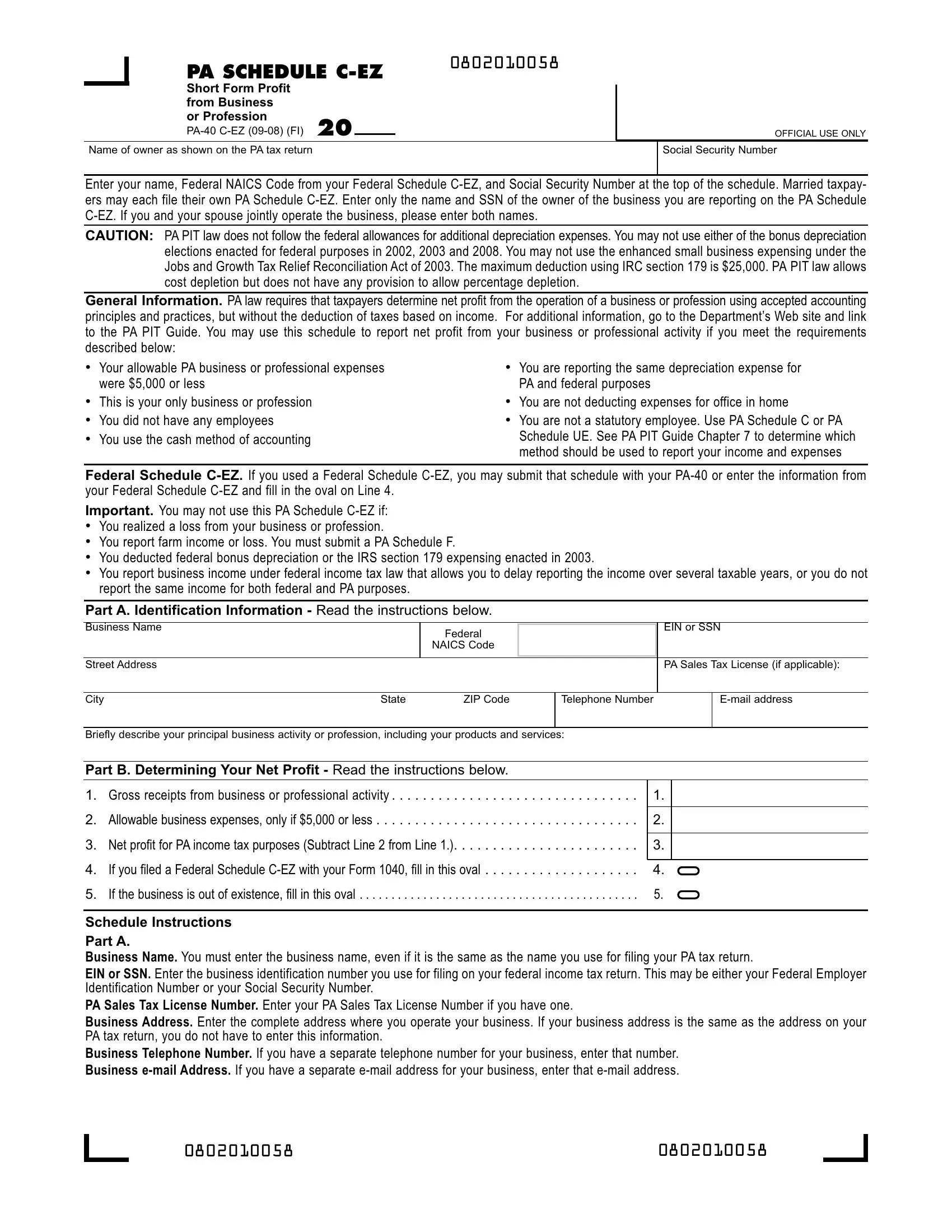

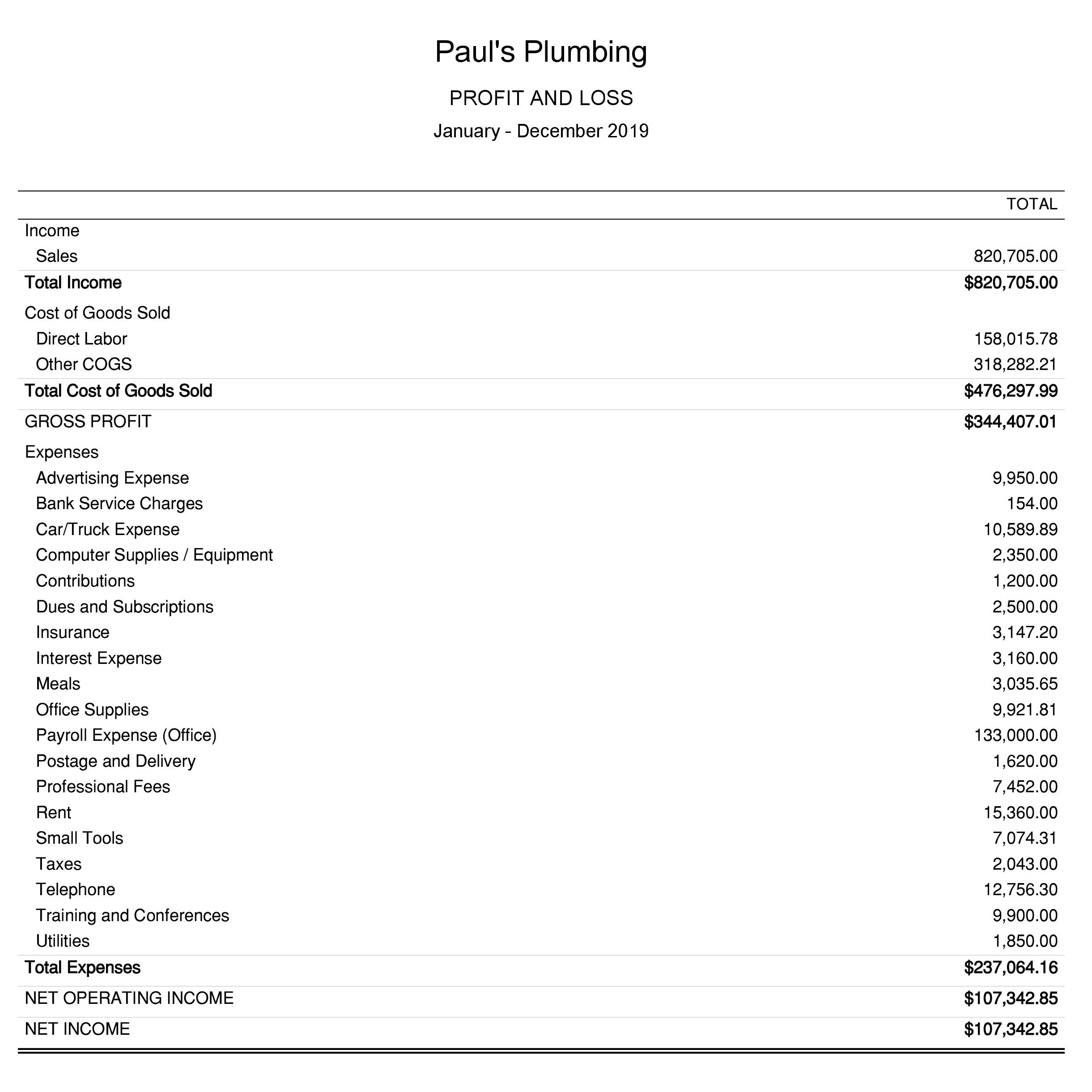

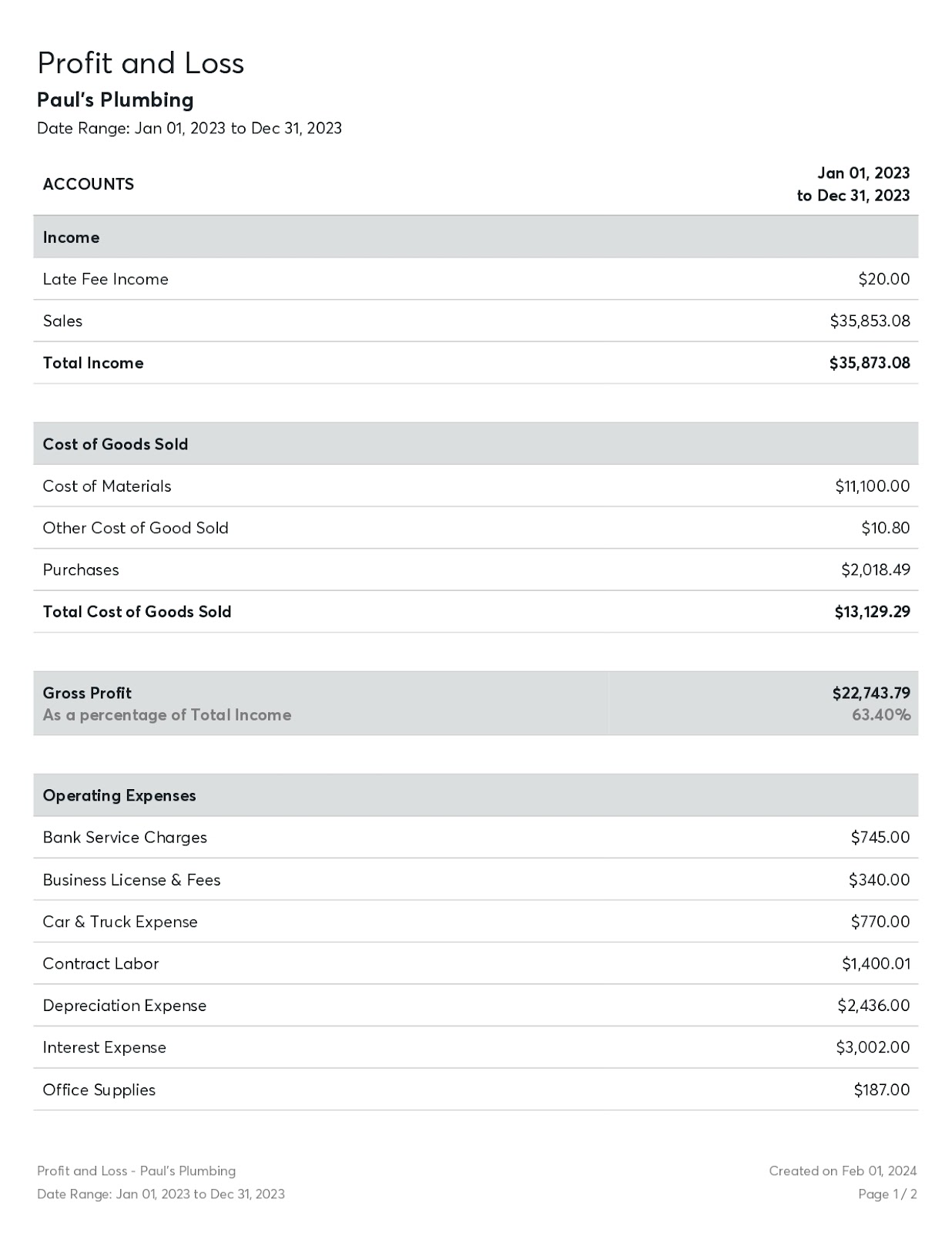

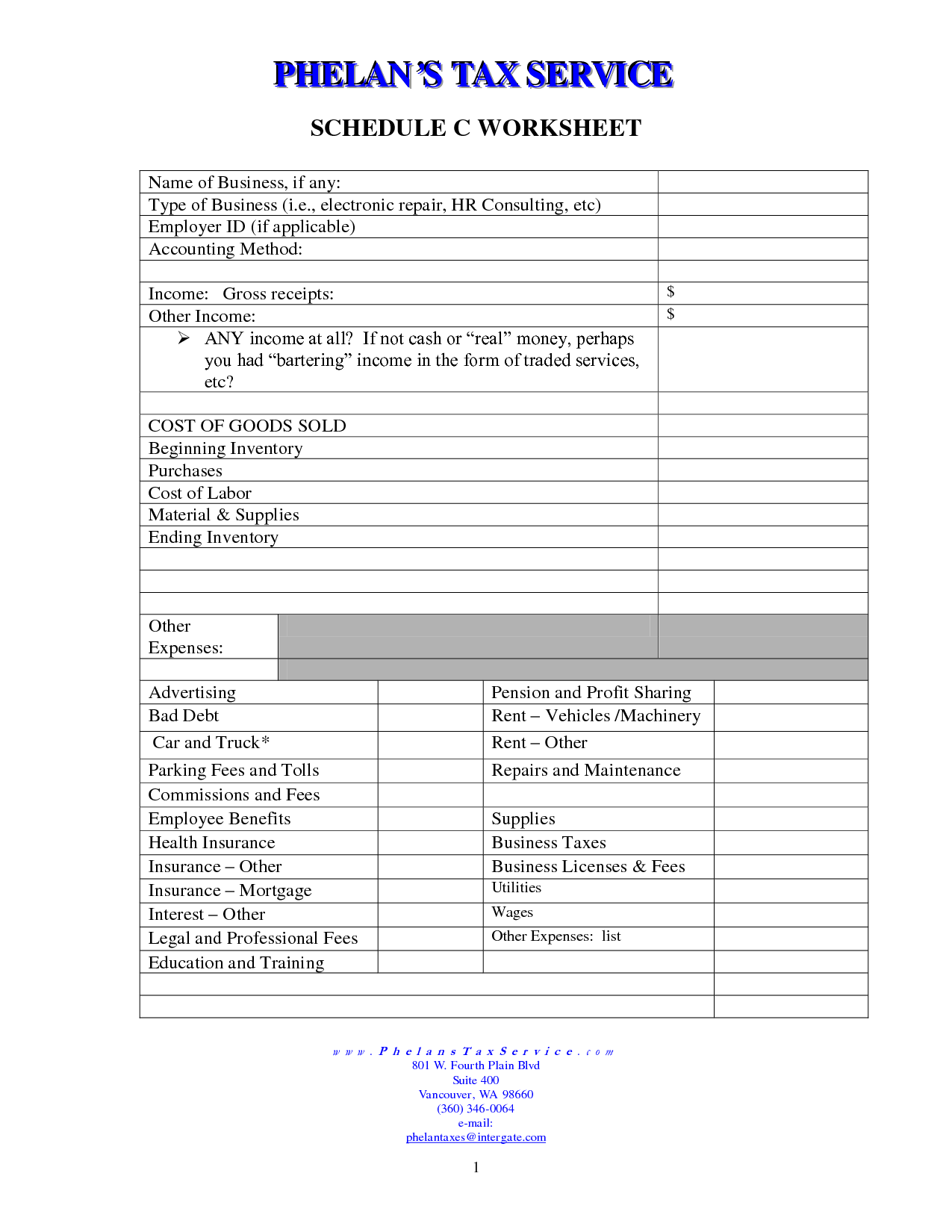

Websep 19, 2022 · schedule c is the linchpin of your independent contractor taxes. It's the form that lets you claim business expenses regardless of whether you itemize your tax. Webfilling out schedule c for your doordash business is a relatively straightforward process. Here are the key sections and questions you need to pay attention to: Webfilling out a schedule c is one of the most effective ways for doordash contractors to pay only what they owe in taxes. Documenting their business income and expenses ensures. If you want to deduct expenses related to your income then you will need. Webuse schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your.

Related Posts

Recent Post

- Arbitron Ratings

- Ottawa County Sheriff Frequency

- Per Diem Nurse Job

- Prius Wont Turn On

- Pilot Central

- Wvu Student Calendar

- Berkeley County Jail Inmates

- Up W Metra Schedule

- Koco5

- Usps Last Pick Up

- Fedex Fulfillment Center Jobs

- Kroger Express Hr

- Visalia Police Academy

- Taeget Optical

- Lake Lure Homes For Sale Zillow

Trending Keywords

Recent Search

- Imdb Old Henry

- Academy Tripod Deer Stand

- Fedex Grounds Careers

- Nyu Spring Break 2024

- When Someone Ignores You Quotes

- Enterprise Late Night Drop Off

- Ktbs News Anchors Fired

- Stabilitrak Chevy Malibu

- Ups Jobs Worcester

- Verizon Tv Commercial Actress

- Natalie Herbick Instagram

- Durango Obituaries

- Kristen Nonconsensual

- Fedex Services Near Me

- Ups Store Close By

/GettyImages-174038203-5a4d1e6de258f80036c28e70.jpg)

:max_bytes(150000):strip_icc()/ScheduleD2022IRS-11353a1e824e41a9a83f83e39fd0f879.jpg)

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)